Here is the list of issues we have been covering — we are up to number 8.

- The Gig Economy

- Millennials

- Climate Change

- Consolidation and/or Decline

- Natural Diamonds vs Lab-Grown

- Banking

- Image

- Demographics

- Retail Evolution

- Industry Structure

_________________________________________________________________

I am always surprised at the range and depth of demographic information that gets published in every media. The flood of data that the federal government and private organizations gather and distribute gives us a remarkable view of where we stand, and where we have been. Maybe even where we are headed.

As ever in demographics, the view is global, or national, and then, if one is interested, it can be sliced and diced even further by state or city. For us in the gem and jewelry business, it is helpful to see macro trends and projections, even though we are such a stratified and fragmented industry that our specific outlooks can vary greatly.

Let's start by looking at longer term trends in the US. As seen in the charts below, we can note the following:

- The number of births per year since 1950 has barely budged, even though the total population has more than doubled. That has taken us below the replacement level (2.1 children per woman), now down to below 1.7. That would indicate a declining population. In spite of that. the US has for many decades done well in that immigration has been strong, making up for declining birth rates. And that has had the added benefit of keeping the average age from rising steeply, a problem that has beset other countries, notably Japan.

- At the same time, the death rate has steadily risen, slightly exceeding the rate of population growth. That appears to be true even though longevity has improved, at least until recently, from about 70 years of age to 80 years of age.

- None of this is special to the US. There are worldwide trends of declining populations, especially in South America and parts of Asia, that could lead, on one hand, to real benefits (better wages, less food shortages, environmental improvement, etc), but also some daunting overall economic pressures (principally, a downward spiral of production needs causing further population declines) . For those interested, read Empty Planet, The Shock of Global Population Decline, by Darrell Bricker and John Ibbotson.

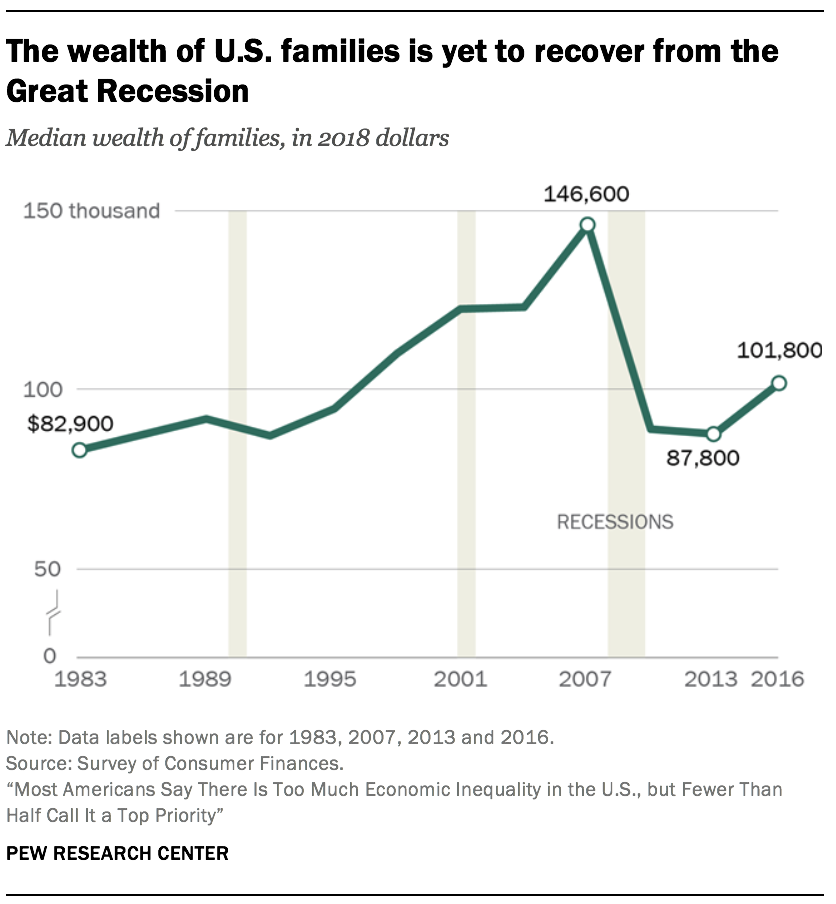

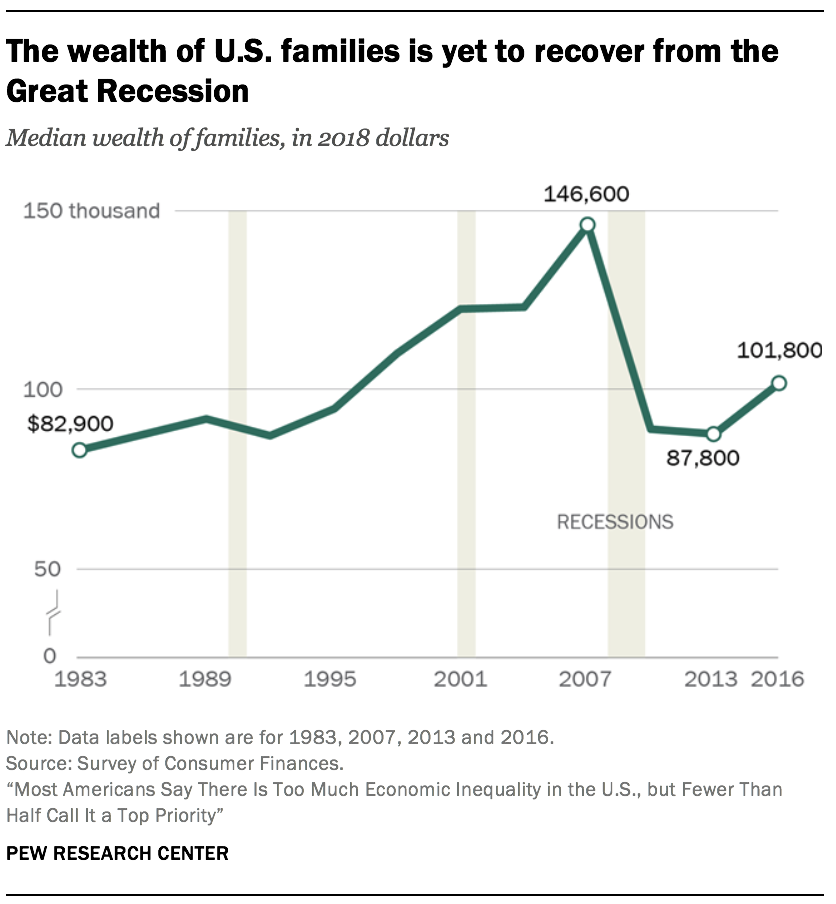

- Much has been written about the stalling growth in wealth for most of US population. Buying power, according to Pew Research, has gone nowhere in 50 years. Their study points out that a $4.00 per hour wage in 1970 has as much buying power as the average wage today of nearly $24.00. Talking about lost buying power in our industry, think of a comparison in the price of gold - $35 an ounce of gold versus $2,000 an ounce.

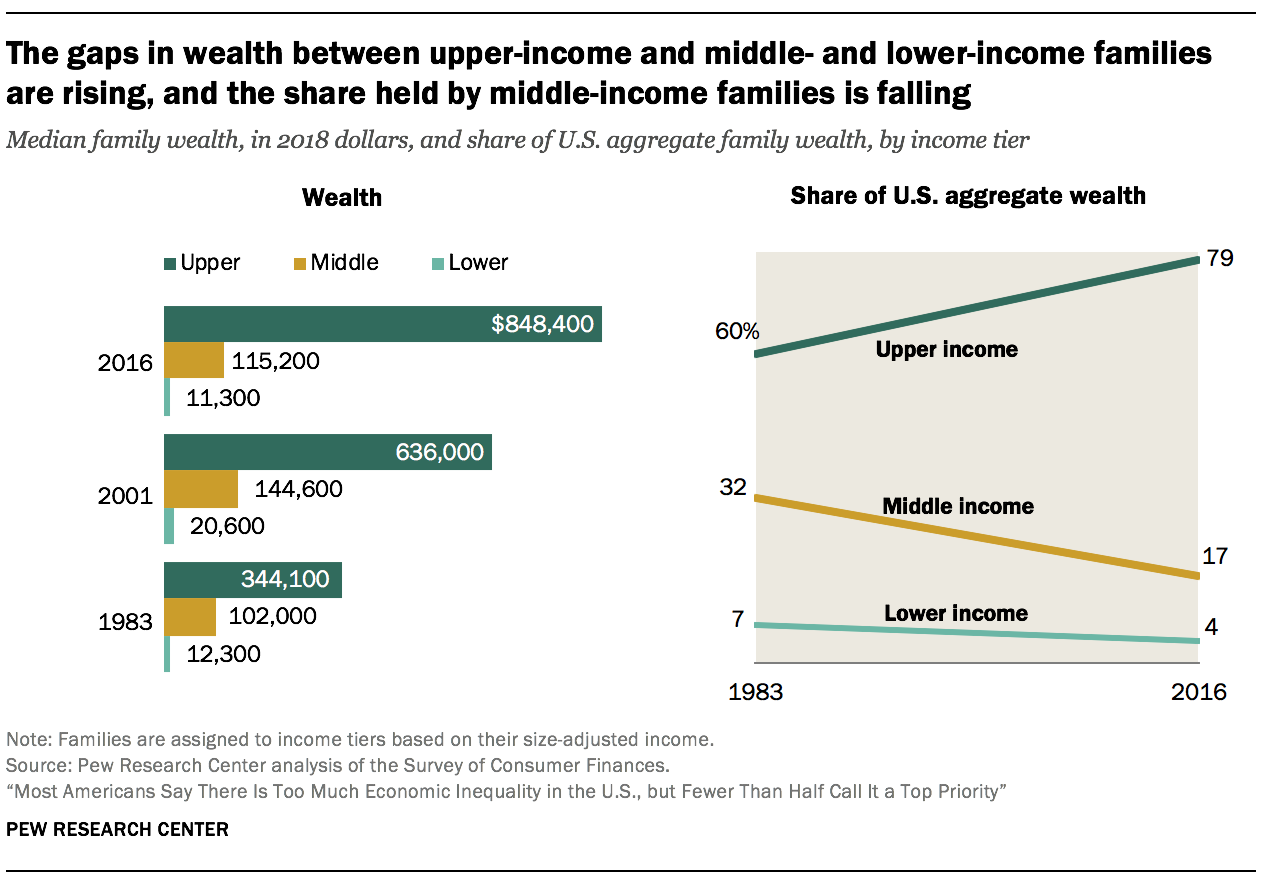

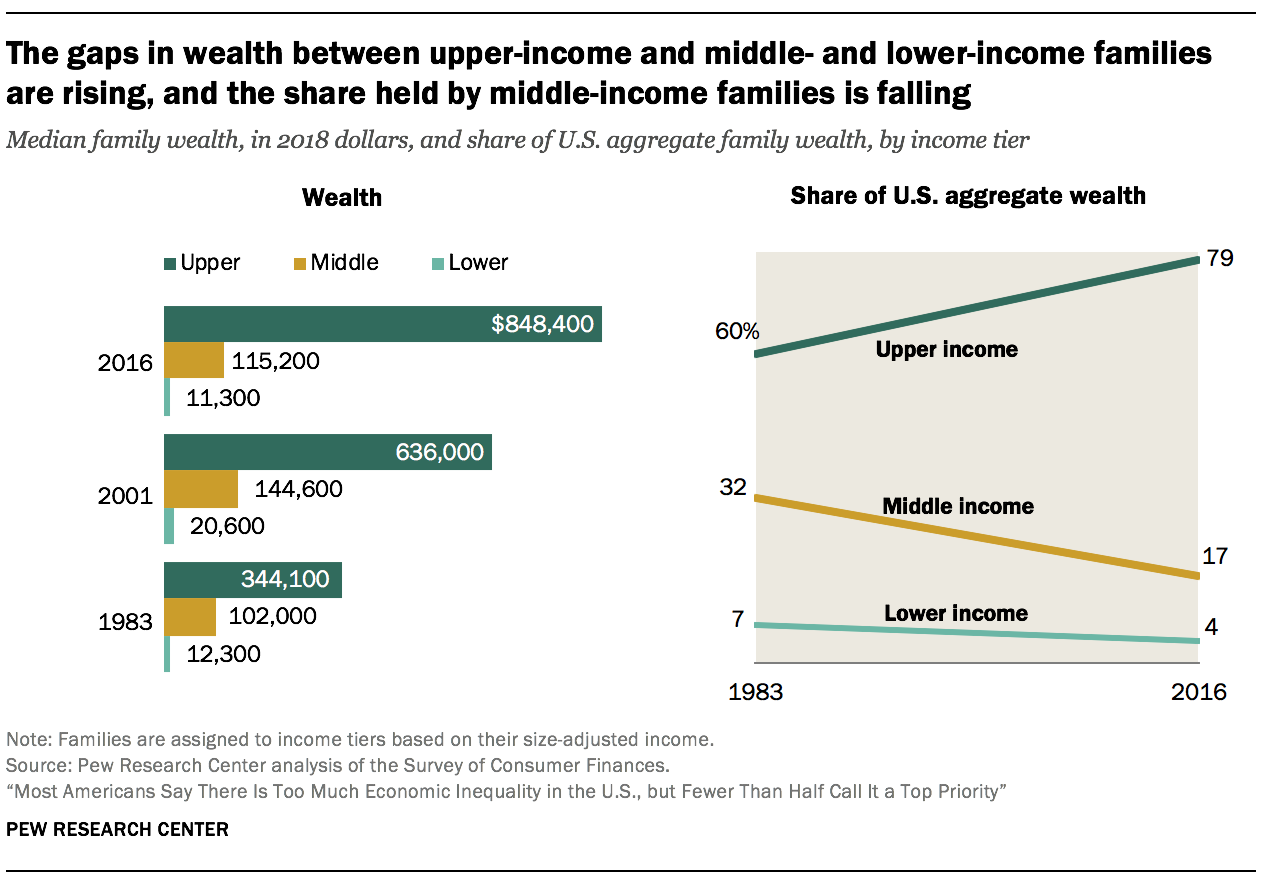

- We know that wealth accumulation has gravitated heavily to the top quartile, but especially to the top 10% of US population. There is a wide range of valid causes, but an important effect has been the steep decline in the middle class and the increased pressure on the lower income population. About half the US population has little or no retirement savings, and that is a looming problem for the country as a whole because everyone will be involved in solving, and paying for, that problem.

Obviously, those companies that deal with the upper income range are doing well, even now, and should continue to do well. Even then, traffic patterns and living patterns are changing and that will bring advantages to some and deficits to others. Think of how many wealthy people have left the cities and how work-at-home has placed so many people full time in the suburbs.

What demographic changes can we foresee? Many people will be going through their savings trying to deal with unemployment. Birth rates could decline even further, at least for some time. A recent article in Bloomberg Businessweek points out that when couples delay having children, typically in an economic downturn, it is often the case that many planned births end up never happening.

Marriages may step up as people opt to make commitments while they still can. When retailers reopened in June, many saw a rush of business as people were able to act on their delayed decisions. That seems to illustrate that public sentiment still seeks to sustain pre-Covid lifestyle.

The income gap, and the wealth gap, will probably get worse. If the government acts vigorously to mitigate income loss until the pandemic is under control, the damage could be limited. In the meantime, we should not be surprised if some of the the longer term demographic changes we have considered seem to be hitting us a lot sooner.

Comments